Economy

Imagine knocking six years off your mortgage just because you asked one question most people forget

When it comes to mortgages, most people focus on the obvious questions: “What’s my interest rate?” “What’s my monthly payment?” “Is this the right time to buy?” And while those are definitely important… there’s one question that often gets overlooked — and yet, it could literally save you years of payments and thousands of…

Read MoreNo W-2? No Problem! Who told you you need a W-2 to buy a home?

Let’s get one thing straight: just because you don’t have a traditional 9-to-5 job with a W-2 doesn’t mean homeownership is out of reach. That outdated idea? Toss it out. In today’s world, the workforce is shifting. More people are building businesses, freelancing, creating content, driving rideshare, and working gigs on their own terms. You’re…

Read MoreHow One Simple Question Can Save You Over $100,000 on Your First Home

Buying a home is one of the biggest financial decisions you’ll ever make. But what if you could save over $100,000 just by asking one simple question when getting pre-approved for a mortgage? The Question That Can Save You Thousands Before you commit to a lender, ask: “Can you provide me with a closing…

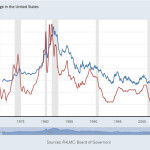

Read MoreSept 21, 2022 Fed Rate Hike

The Fed has once again raised their Fed funds rate by an expected .75 percent. As we explained in previous posts about Fed rate hikes, this is not a direct increase to mortgage rates, but the Fed’s move does have an impact on the mortgage marketplace and the broader economy. The most recent rate hike brings…

Read MoreThe Lastest Fed Hike

Once again, in an effort to curb inflation, the Fed has announced another Fed Rate Hike to the tune of a .75 increase to the Fed Funds rate. This Fed rate hike brings the Fed funds target rate range to 2.25%-2.5%, and the increase was in line with expectations, resulting in minimal initial changes to…

Read MoreWill Inflation Go Down?

There’s a lot of economic jargon being tossed around in headlines these days, and one of the hot topics out there is inflation. To start, it’s important to understand what inflation is. When the value of a currency diminishes, the result is inflation – basically, you get less for the same or more. The cost…

Read MoreWhat the Fed Rate Hike Means for You

Today the Fed increased their Fed Funds rate by .75 percent. While on the surface that doesn’t seem like too big a bump, this is the largest single-day increase to the Fed funds rate since 1994, signaling a serious attempt at Fed members to reign in inflation. The move comes on the heels of last…

Read MoreWhat the Fed Rate Hike Means for My Mortgage

How the Fed Rate Hike Affects Mortgage Rates Yesterday, March 16, 2022, was the date of the first Fed rate hike in 3 years, and is the first of an expected 7 total for the year 2022. This rate hike is an effort to fight off the inflation once deemed “transitory” but has proven…

Read More