Posts Tagged ‘economy’

How to Find Cash-Flowing Rental Properties Online: 4 Game-Changing Tools

Let me take you back to when I bought my very first rental property. I was excited, motivated… and completely overwhelmed. Zillow felt like a black hole. Facebook Marketplace was giving sketchy Craigslist vibes. And every time I thought I found a good deal, I wasn’t even sure what “good” meant. I didn’t know which…

Read MoreYou’ve been lied to about down payments—and it’s costing you big

Let’s bust a myth that’s holding way too many people back from buying a home. You’ve probably heard it: “You need 20% down to buy a house.” And while it sounds responsible and smart on the surface, it’s not always the winning strategy people think it is. In fact, waiting until you have 20%…

Read MoreHomebuying Success Series

Joining this series will give you priceless information you need to reach your goal of homeownership. I will be sharing with you from start to finish of the homebuying process, to ensure you will know what to expect, and help you prepare to secure the best future for you and your family. There are 6…

Read MoreIs It a Good Time to Buy a House?

Is It a Good Time to Buy a House? This question is one of the most common questions we see from consumers, investors, real estate agents, and many others with interest in the real estate market. The answer is ‘yes’. But it also depends on your specific situation, what’s important to you, and where…

Read MoreSept 21, 2022 Fed Rate Hike

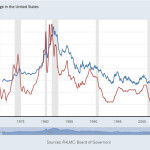

The Fed has once again raised their Fed funds rate by an expected .75 percent. As we explained in previous posts about Fed rate hikes, this is not a direct increase to mortgage rates, but the Fed’s move does have an impact on the mortgage marketplace and the broader economy. The most recent rate hike brings…

Read MoreWill Inflation Go Down?

There’s a lot of economic jargon being tossed around in headlines these days, and one of the hot topics out there is inflation. To start, it’s important to understand what inflation is. When the value of a currency diminishes, the result is inflation – basically, you get less for the same or more. The cost…

Read MoreWhat the Fed Rate Hike Means for You

Today the Fed increased their Fed Funds rate by .75 percent. While on the surface that doesn’t seem like too big a bump, this is the largest single-day increase to the Fed funds rate since 1994, signaling a serious attempt at Fed members to reign in inflation. The move comes on the heels of last…

Read MoreWhat the Fed Rate Hike Means for My Mortgage

How the Fed Rate Hike Affects Mortgage Rates Yesterday, March 16, 2022, was the date of the first Fed rate hike in 3 years, and is the first of an expected 7 total for the year 2022. This rate hike is an effort to fight off the inflation once deemed “transitory” but has proven…

Read More