blog

What the Fed Rate Hike Means for You

Today the Fed increased their Fed Funds rate by .75 percent. While on the surface that doesn’t seem like too big a bump, this is the largest single-day increase to the Fed funds rate since 1994, signaling a serious attempt at Fed members to reign in inflation. The move comes on the heels of last…

Read MoreHELOC vs REFINANCE

HELOC VS Refinance – the clash for cash If you need to access cash from your home equity and have no interest in selling, in most cases you’re left with limited options to tap into the equity you’ve likely grown over the past few years of high appreciation. It often boils down to a…

Read MoreWhat is a Rent Back?

What is a Rent Back? In today’s housing market inventory is low and buyer demand is high. In such a market, many buyers need to get creative in structuring their offer on a home, and many sellers (future buyers) need to consider the fact that they, too, will soon encounter the same challenges that buyers…

Read MoreWhat the Fed Rate Hike Means for My Mortgage

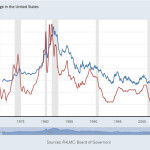

How the Fed Rate Hike Affects Mortgage Rates Yesterday, March 16, 2022, was the date of the first Fed rate hike in 3 years, and is the first of an expected 7 total for the year 2022. This rate hike is an effort to fight off the inflation once deemed “transitory” but has proven…

Read MoreGiving Our Buyers the Edge with Buyer’s Advantage

At MasonMac, we work to consistently give our home buying customers an advantage in the market place. In today’s market, more than ever, it’s important that buyers have an edge and every advantage they can get, and that’s where MasonMac’s Buyer’s Advantage program comes in! With Buyer’s Advantage, MasonMac not only preapproves customers through…

Read MoreShould You Pay Points?

Should You Pay Points? When getting a mortgage, one of the most important things to pay attention to is the cost of the loan being applied for. There are certain fees customers can shop for that may be drastically different from one lender to another (for example, discount points, and lender fees) and some fees that…

Read More2022 Conventional Loan Limits

Each year toward the end of November, FHFA (Federal Housing Finance Authority, the agency overseeing Fannie Mae & Freddie Mac) releases updated loan limits for the following year. This sets the maximum amount of money that can be borrowed under conventional lending guidelines. Today’s announcement informed us that for 2022, conventional loan limits will be…

Read More